|

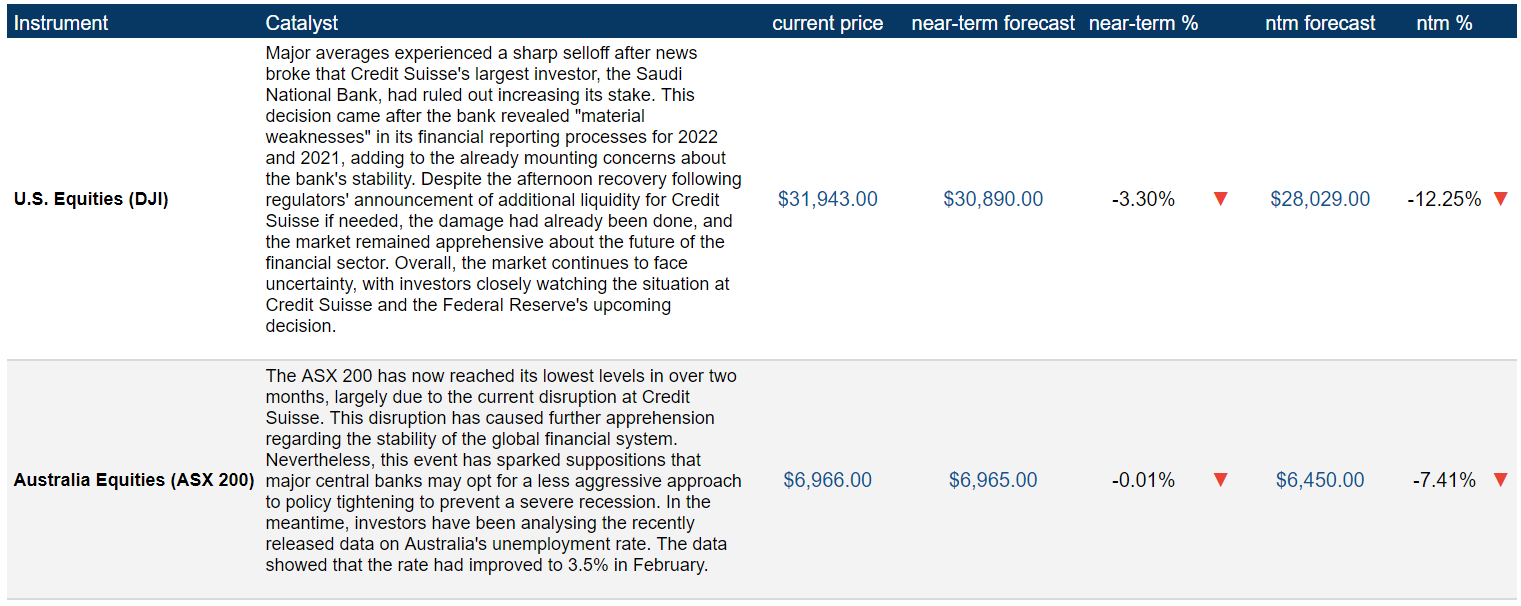

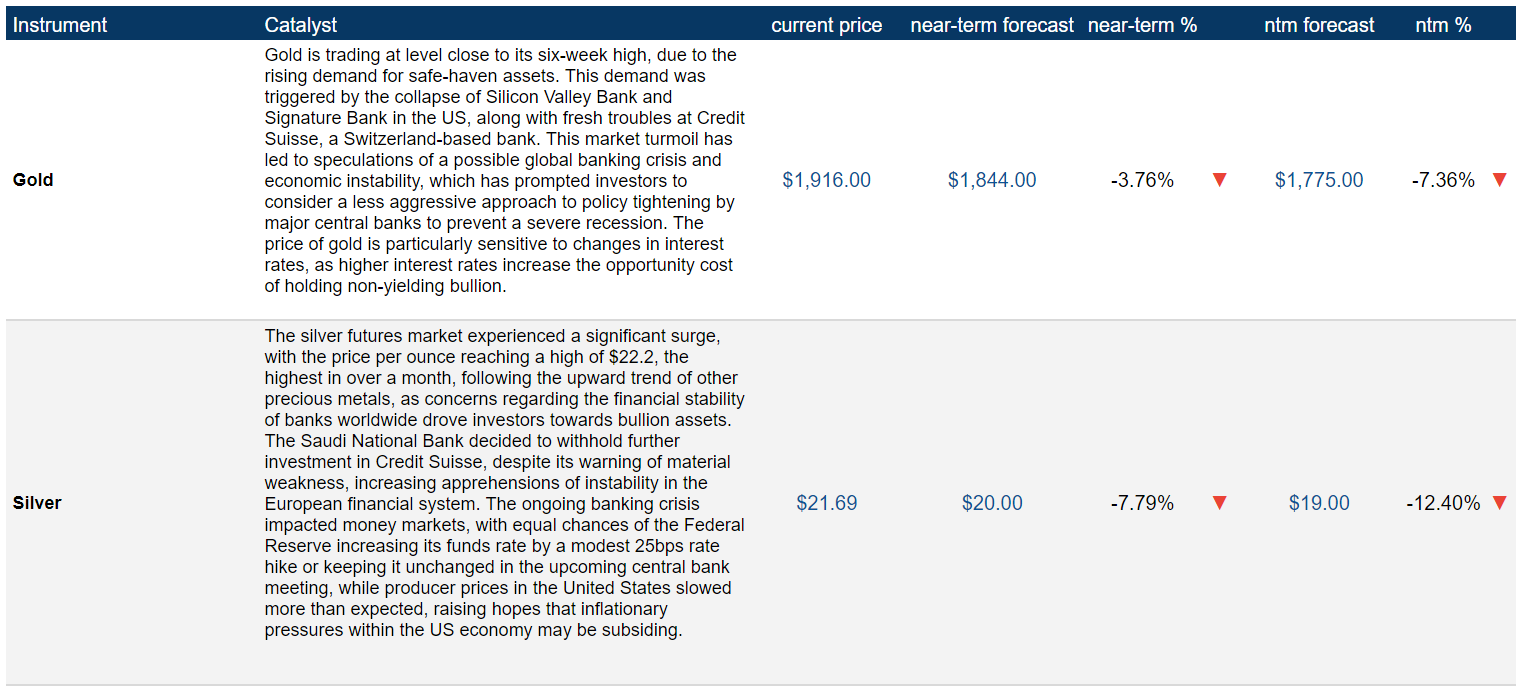

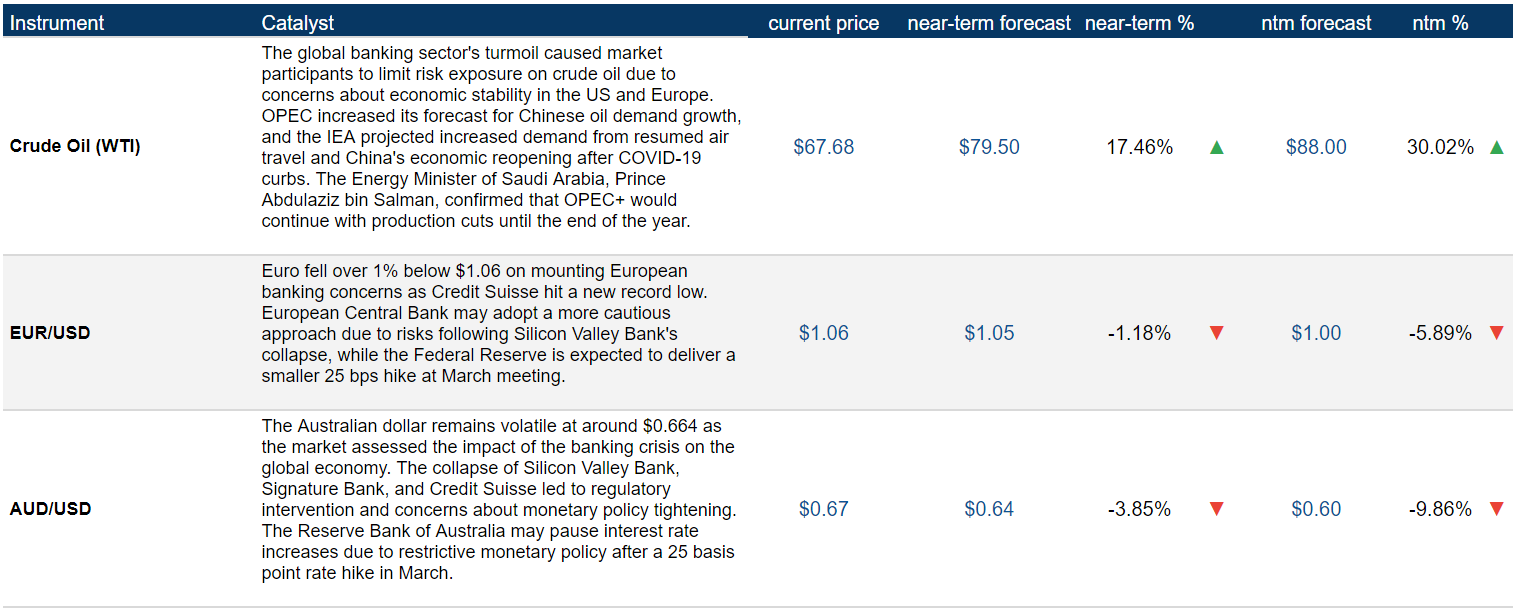

Source: Zohar Lazar Concerns are mounting among investors and analysts following the recent failures of Silicon Valley Bank (SVB) and Signature Bank, as the impact on the broader economy remains uncertain. Speculation is rife that the U.S. Federal Reserve may hold off on further interest rate increases in the coming weeks, as they assess the potential fallout from these developments. There are also fears that a banking crisis could be on the horizon. Adding to these concerns, Credit Suisse has experienced a significant drop in share prices, plummeting by over 25% to a record low on Wednesday. The bank’s largest shareholder, Saudi National Bank, has announced that it will no longer provide any financial assistance, sparking widespread anxiety in the market. This latest development comes at a precarious time, as fears of another financial crisis have begun to mount in the wake of the collapse of SVB. Many are now questioning whether this is a signal of deeper problems within the banking sector, as investors reassess their positions. The unexpected news has sent shockwaves through the markets, prompting many to wonder about the long-term impact on the wider financial landscape. As experts scrutinise these developments, it remains to be seen whether more banks will fall victim to this current crisis, or if governments and regulatory bodies will intervene to prevent a wider catastrophe. The market is now firmly fixed on the unfolding situation, as market participants scramble to make sense of what is happening and prepare for what may lie ahead. Source: Bloomberg: Credit Suisse share prices have hit an all-time low, dropping by a staggering 97% from its previous all-time high Our Trade Ideas for the Upcoming WeeksThe ContextFederal Reserve Faces Dilemma: Bank Failures Raise Caution over Interest Rate Hike

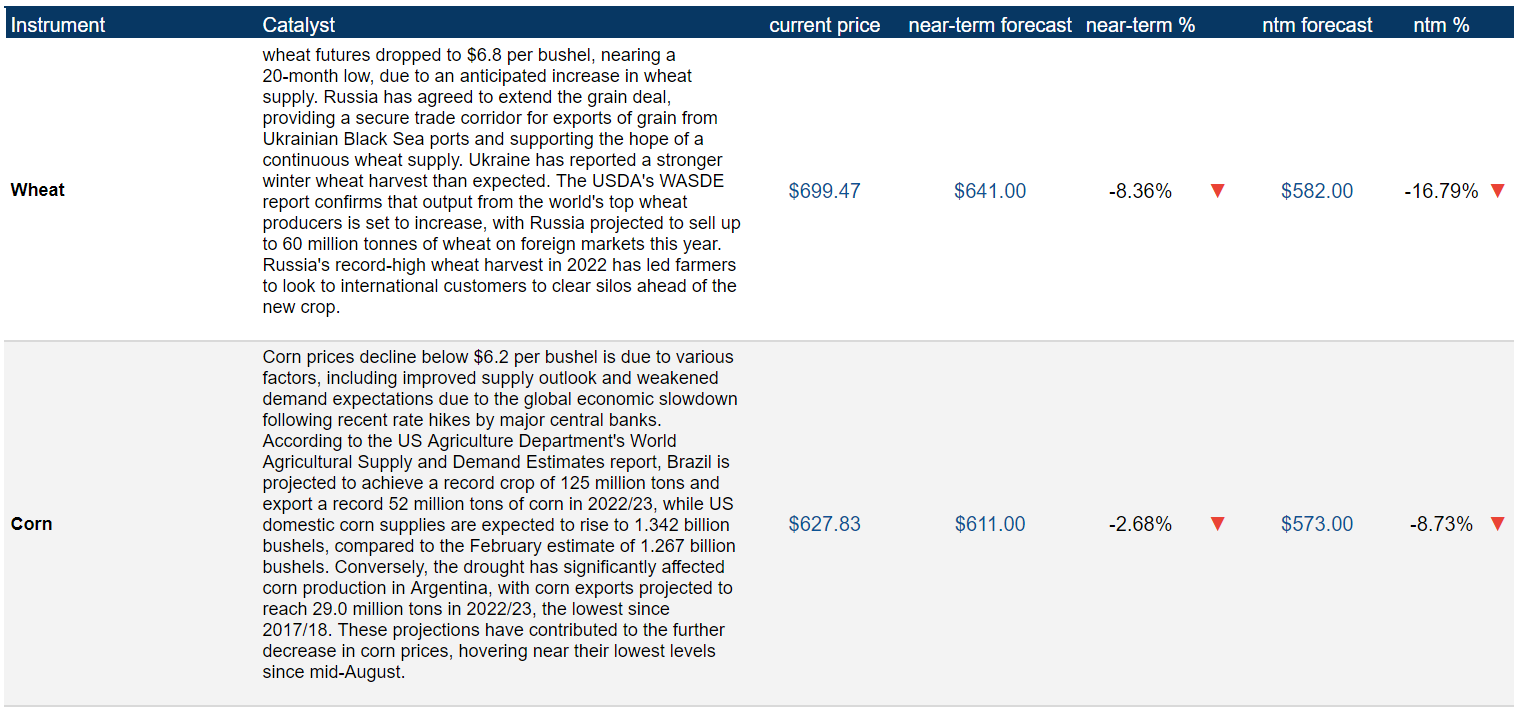

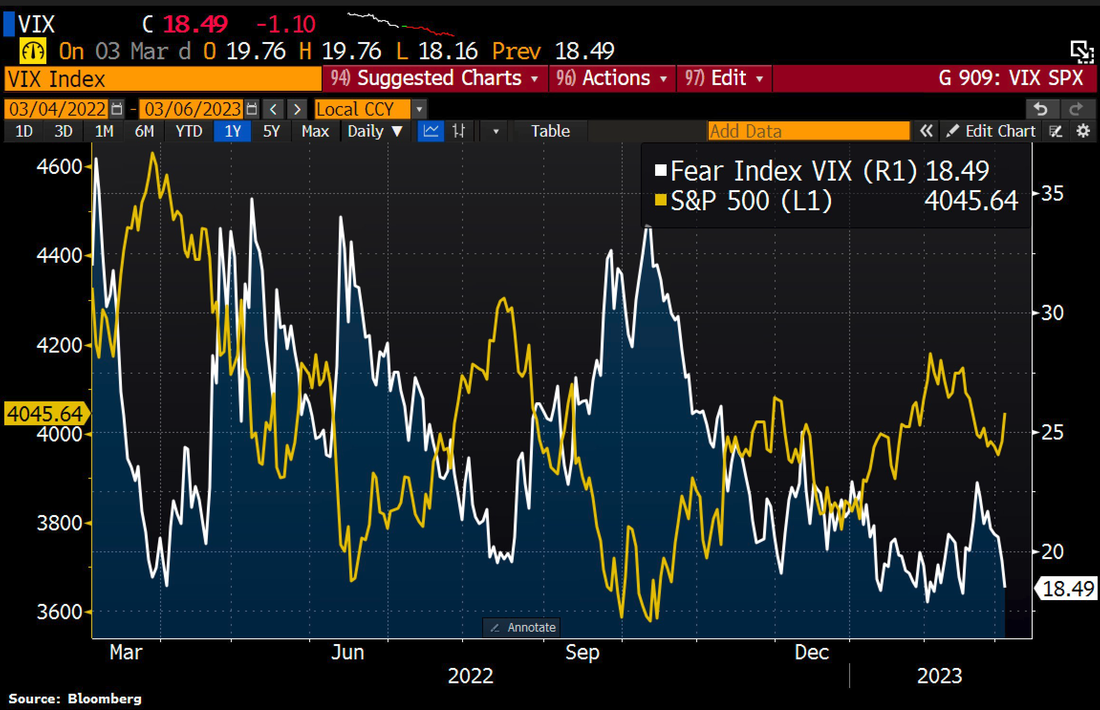

In our view, the recent failures of SVB and Signature Bank have raised serious concerns about the potential risks of raising interest rates, and Federal Reserve policymakers should be cautious about increasing rates at their upcoming meeting next week. The recent bank collapses have highlighted the fragility of the economic environment and the potential negative consequences of raising rates. Although there have been fluctuations in inflation reports, the strong January employment report and high inflation rates have also presented opportunities for growth. Fed Chairman Jerome Powell’s hawkish testimony last week initially led to predictions of a half-point interest rate increase, but the likelihood of that has since diminished. We believe that the Fed is hesitant to raise rates and counteract its efforts to contain the fallout from the bank failures, as it could further damage the already uncertain banking system and cause a chilling effect on the economy. However, we remain optimistic that the Fed will take a cautious approach to avoid further economic damage. Despite the challenges, the February jobs report was strong, and we believe that the current economic environment presents opportunities for growth. The Fed cannot ignore the risks of inflation, we think policymakers would be cautious about the potential negative consequences of raising interest rates in the current environment. In our view, if the economic data remains strong, the Fed will likely resume its efforts to raise rates, but policymakers would continue to take a measured approach to ensure long-term economic stability. Source: Gettyimages A Look Ahead: Our Forecast from March OnwardsThe global markets suffered in February due to concerns over U.S. inflation and interest rates, with the majority of markets around the world taking significant hits. However, there are reasons for optimism as consumer-related sectors are expected to experience growth in various regions, such as China. The Chinese economy is poised for recovery, as households have accumulated an unprecedented level of savings, and consumption growth is predicted to rebound to 7% in 2023. As China’s economy reopens, increased spending is expected, which will boost not only its own economy but also have a significant impact on global economic growth and commodity demand. Despite the challenges faced in the early part of the year, there are signs of brighter economic conditions ahead, offering hope for investors and businesses alike. In this macro context, our algorithm has identified the optimal portfolio and trade allocation that guarantees the highest risk/reward ratio. Our solution offers a smarter way to trade, delivering unmatched performance and results: The ContextAt the start of the year, the global market was on a roll! Everything seemed to be going well, and there was a lot of excitement about what the year ahead might hold. But then, things took a turn for the worse in February. Market sentiment declined, and people started to worry about what was going on. It turned out that the decline was due to concerns about the Federal Reserve. Rumours were going around that they would have to keep hiking rates for a longer period to bring down U.S. inflation. This caused global yields to increase. To make matters worse, futures markets started predicting that there would be a peak in the federal funds rate of 5.46% this autumn, up from 4.8% at the start of February. This means that people were expecting interest rates to go up even more than they already had! The economic landscape is in a constant state of flux, and February 2023 was no different. During the last month, various global events occurred, which had a significant impact on the financial markets. The consequences of these events were felt worldwide, with some of the most significant impacts being seen in the MSCI All Country World Index and the S&P 500. Thus, the MSCI All Country World Index, which tracks the performance of stocks in both developed and emerging markets, took a hit in February. The index lost 3% during the month, which was a significant drop from the 7% rise seen in the previous month. This significant decrease in value sent shockwaves through the global economy, and many investors were left scrambling to re-evaluate their investments. Similarly, the S&P 500 also tumbled during the month. After a healthy 6.2% climb in January, the index fell by 2.6% in February. This unexpected decrease in value came as a surprise to market participants who were hoping to build on their gains since the beginning of the year. Source: Bloomberg The poor performance of these indices throughout February was a clear indication that it wasn’t a great start to the year for the global financial markets. The MSCI All Country World Index and the S&P 500 are two of the most closely watched indicators of market performance, and their decline was a cause for concern for many investors worldwide. Events in February 2023 had far-reaching effects on the global economy, and it remains to be seen how markets will respond in the coming months, but one thing is for sure: the market will be subjected to further volatility as market participants will react to upcoming economic data releases. Whilst the U.S. interest rate outlook remains uncertain, there are still reasons for optimism. Consumer-related sectors are anticipated to experience growth as various regions around the world reach early inflexion points, presenting opportunities for investors. Therefore, despite the challenges, there is still hope for the year ahead. Chinese households have accumulated over US$ 665 billion in savings, driving consumption growth to rebound to 7% in 2023The COVID-19 pandemic has dramatically changed the way people live their lives, and China has been particularly affected. To curb the spread of the virus, the Chinese government has taken drastic measures and imposed restrictions on movement that lasted for three years. These measures forced people to stay at home and considerably reduce their spending, resulting in a significant increase in household savings. As a result, according to estimates, households in China have accumulated an impressive amount of extra money, totalling around US$ 665 billion. This unprecedented level of savings is due to the fact that people were unable to go out and spend their money as usual. But what does this mean for the Chinese economy? Extra money injected into the Chinese economy is expected to boost consumption and drive economic growth, according to experts. Consumption growth is predicted to rebound to 7% this year, a substantial improvement from the near-zero levels observed in 2020. This is welcome news for the Chinese economy, which heavily relies on domestic consumption. As the country’s economy reopens, there are already signs of increased consumer spending. Sales for leisure activities such as going to the cinema and dining out during the Chinese New Year holiday were higher than they were in 2019 before the pandemic hit. Domestic and international travel is also starting to pick up again, indicating a pent-up desire to spend money. To further encourage spending, the Chinese government is implementing policies to boost consumption. President Xi Jinping has stressed the importance of domestic consumption for economic recovery, and China’s Ministry of Commerce is rolling out policies that focus on areas like automobiles and home appliances. As we head into the second quarter of the year, the trend of increased spending is expected to continue steadily. This is good news for businesses that depend on consumer spending, including those in the consumer, internet, medical equipment, and transportation industries. All in all, the signs point to brighter economic conditions for China as we are entering into Q2-2023, and as the country continues to recover from the COVID-19 pandemic. A question that emerges is how China’s reopening will boost the growth of the global economy? China’s Reopening Set to Drive Economic Recovery, Boost Global GDP and Commodity DemandWe anticipate that China’s economic recovery from the pandemic is expected to not only boost its own economy but also have a significant impact on global economic growth. According to Goldman Sachs Research, China's GDP is forecasted to grow by 6.5% in 2023 on a Q4/Q4 basis, owing to its faster-than-expected rate of reopening. The reopening of the Chinese economy is also expected to increase domestic demand, further stimulating economic growth. It is anticipated that the reopening and recovery of Chinese domestic demand could raise global GDP by 1% by the end of 2023. The projected increase in Chinese economic activity is great news for the global economy, as it signifies the return of one of the world’s largest and most important economies to pre-pandemic levels.

We can expect China’s reopening to have a direct and positive impact on global economic growth through three key channels:

China's Reopening: A Double-Edged Sword for Global Economic Recovery, with Potential for Both Boost and Inflation Concerns The Covid-19 pandemic has had a severe impact on the global economy, with many countries experiencing economic downturns. However, with China’s reopening, we can expect a much-needed boost to the global economy, which will help to mitigate the damage caused by the pandemic. The recovery of the Chinese economy is a positive sign for the global economy, and we are closely monitoring the reopening progress in the coming months. However, we remain cautious, as we think that the direct impact of the reopening on GDP outside of Asia will be relatively modest. We believe that the wider effects of Chinese growth, including more favourable global financial conditions and increased trade with other nations, will be more significant. On the other hand, we also expect global inflation to increase following China’s reopening. While most economies may experience a minimal impact on core inflation, we predict that rising commodity prices may lead to headline inflation, especially for oil-dependent emerging markets. In this regard, we project that China could contribute to a half-percentage point boost to headline inflation in many economies. We think that the reopening of the Chinese economy could potentially bring higher inflation, which could lead to central banks hiking rates further than anticipated to keep growth in check and tame inflation. |

About

Archives |

RSS Feed

RSS Feed